Through insurance and land planning, tax sources can be reserved in advance, assets can be magnified, and descendants can avoid giving up inheritance because they cannot afford inheritance tax. Insurance claims enjoy tax exemptions, and real estate disposal can be selected according to the years of acquisition and appreciation potential, through direct inheritance, gift or sale inheritance, to achieve the best tax saving effect. Combined with age, existing insurance policies, and types of property, accurate arrangements can be made to make inheritance safer and the second half of life less worrying.

If the inheritance exceeds the tax-free amount, the tax must be paid before the inheritance, otherwise the property cannot be transferred. Many people are forced to abandon their inheritance or raise money because they do not have a "reserved tax source". Early planning and legally enlarging the reserved tax source can ensure that the hard-earned wealth can be smoothly passed on to future generations and avoid the family from facing the pressure of huge inheritance taxes.

I am not an insurance agent who only sells insurance policies, but a consultant who is committed to helping you with asset allocation and legal tax saving. From insurance license to land surveyor, I continue to study to integrate land, taxation and finance to help you find cash flow and potential assets. Do you want to talk about how to maximize the benefits of assets? You can slowly read my articles, or let's make an appointment to talk!

There is no excerpt because this is a protected post.

Insurance is not a tool to get rich, but a safety net to prevent risks from ruining you all at once. If you are the breadwinner of your family or cannot afford the pressure of an unexpected situation, you should configure appropriate protection. On the contrary, if your finances are sound, insurance plays a supporting role and funds can be used flexibly.

Many people think that buying a "lifetime actual payment medical insurance" will provide lifetime coverage, but in fact, most products have an upper age limit for claims, which is usually 75 or 80 years old. Lifetime means that the policy is valid, but it does not mean that the payment will be for life. It is recommended to read the terms and conditions carefully to confirm the coverage period and evaluate whether other policies are needed to supplement the coverage, so as to truly protect the medical needs of the elderly.

There are two logics for medical insurance: one is the "return type" with higher premiums but refundable upon maturity, which is suitable for people who value the sense of return; the other is the "pure protection type" that focuses on protection and has lower premiums, which is suitable for people who want to use a small amount of money to support high protection. There is no better one, the key lies in what you need most now.

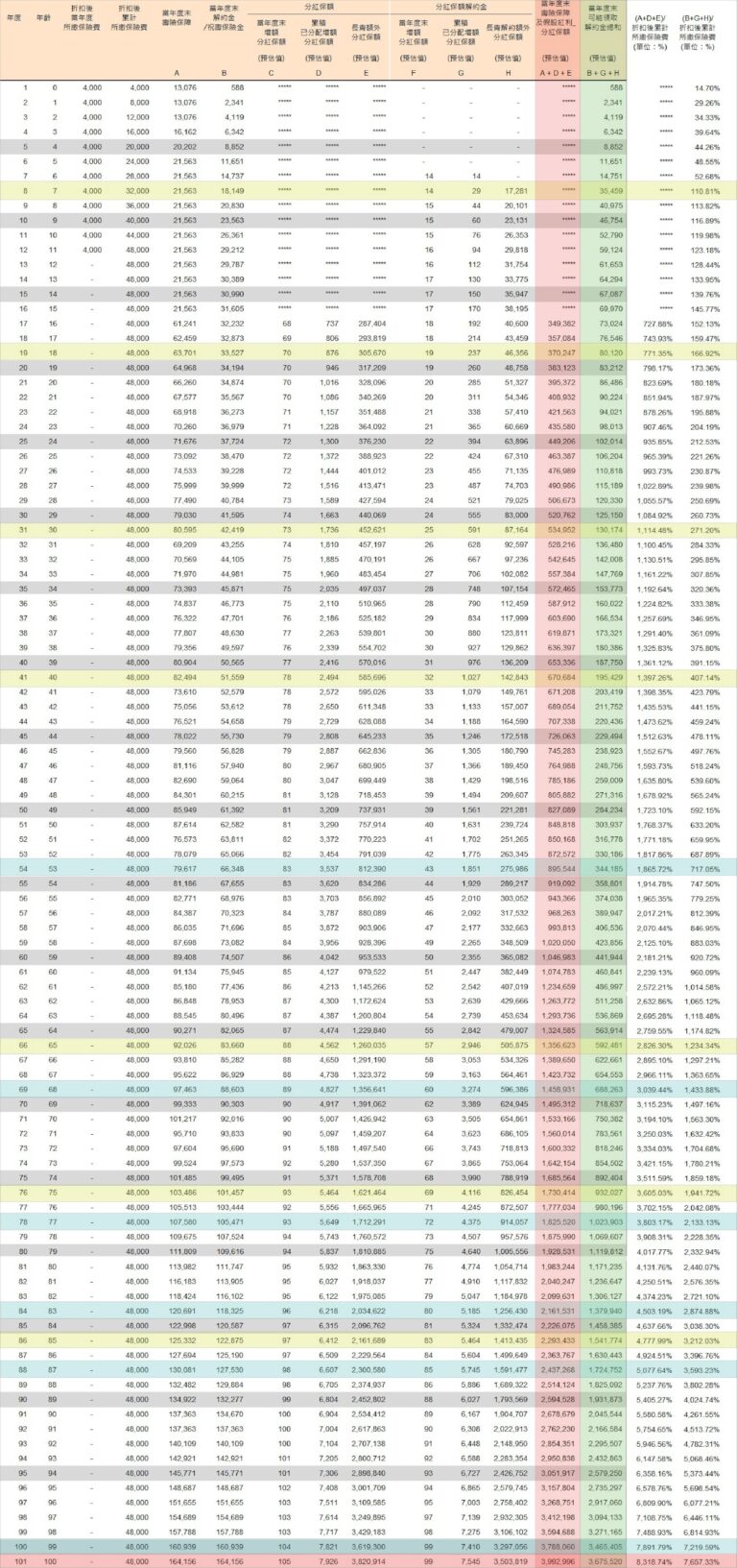

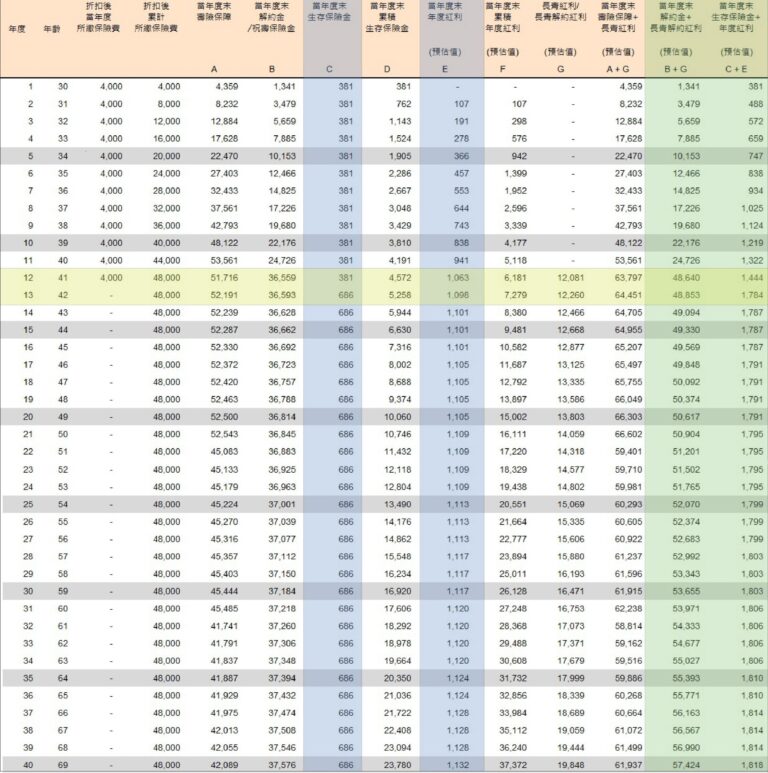

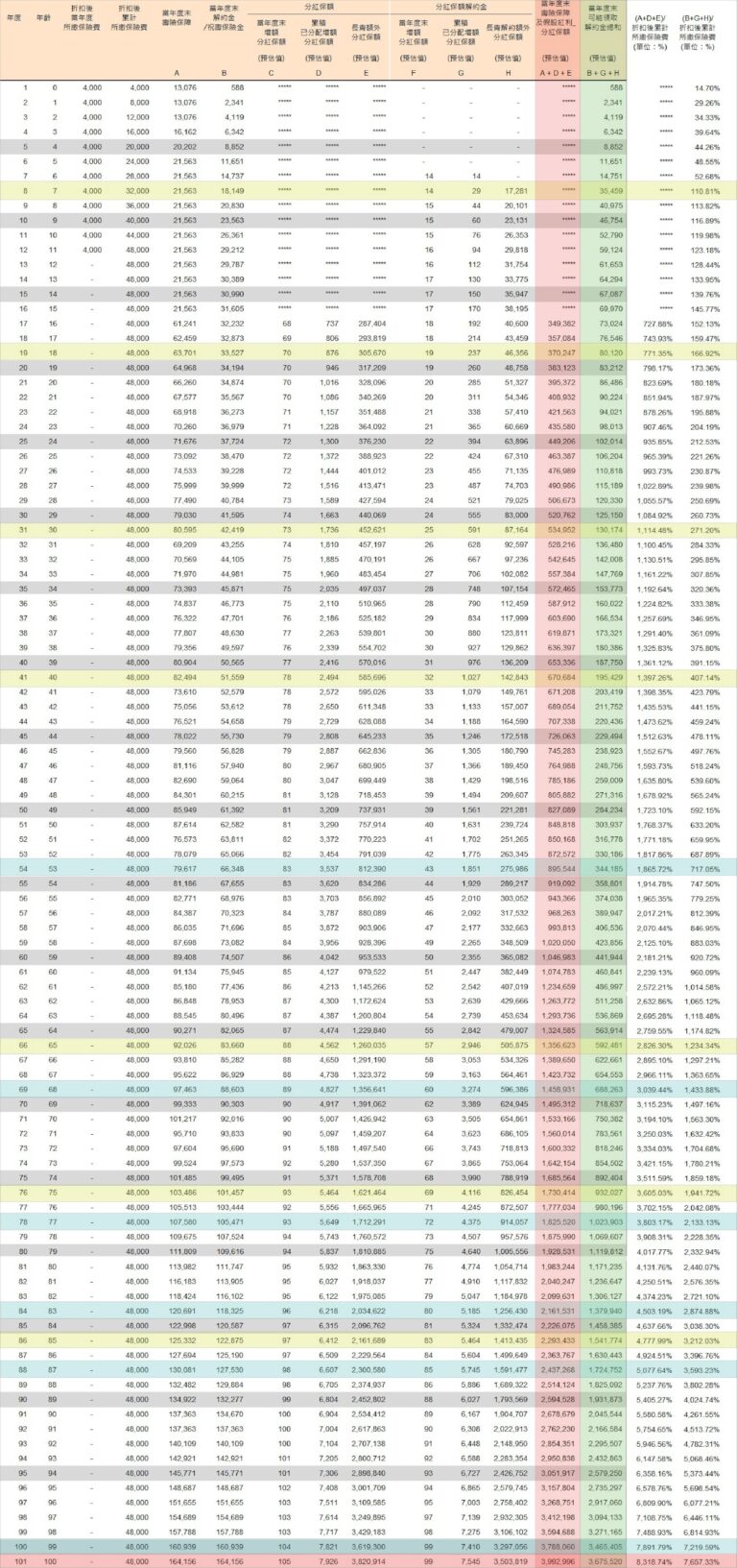

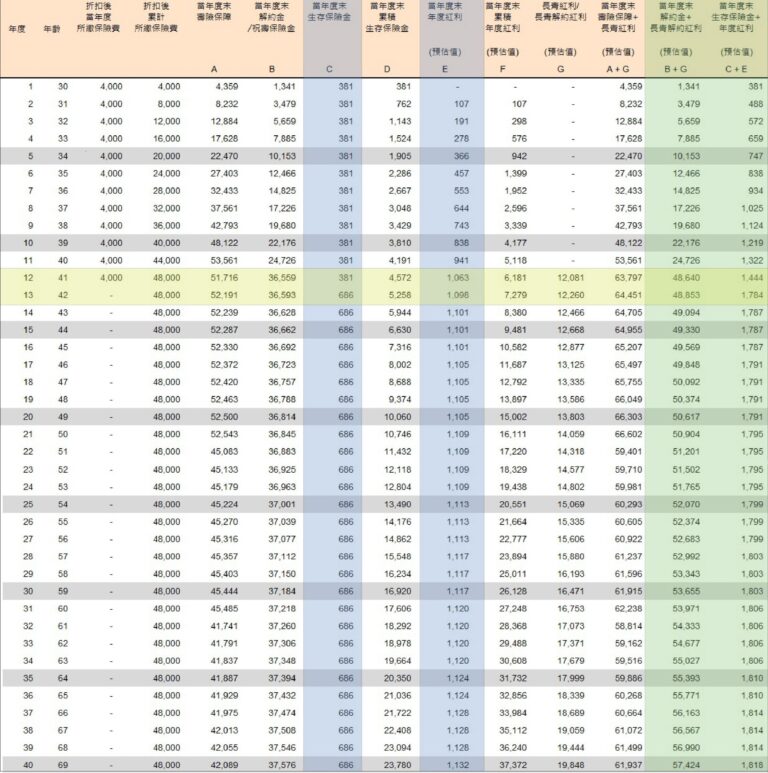

As long as you save 10,000 yuan a month for 12 consecutive years, you will have the opportunity to build an asset of 1.5 million yuan. At the same time, you will start to receive rewards from the first year, which will increase year by year, up to about 55,000 yuan per year. As long as the principal is not moved, this cash flow can even last a lifetime. In the long run, not only will the principal remain, but the total amount of rewards may far exceed the investment, becoming one of the sources of stable income after retirement. This is a stable long-term savings strategy that can be customized according to personal conditions.

After the old man who caused the Three Gorges accident passed away, if his family members gave up the inheritance, they would be exempt from paying compensation to the victims. Compulsory insurance and third-party liability insurance become the key to the victims' families' claims for compensation. If the elderly person’s insurance policy does not specify another person as the beneficiary, the compensation money will be considered as the inheritance for repayment; if someone else is specified, the insurance money will not be included in the inheritance and the family members can legally collect it. This case highlights the importance of insurance planning and third-party liability insurance.