There is no excerpt because this is a protected post.

Insurance is not a tool to get rich, but a safety net to prevent risks from ruining you all at once. If you are the breadwinner of your family or cannot afford the pressure of an unexpected situation, you should configure appropriate protection. On the contrary, if your finances are sound, insurance plays a supporting role and funds can be used flexibly.

Many people think that buying a "lifetime actual payment medical insurance" will provide lifetime coverage, but in fact, most products have an upper age limit for claims, which is usually 75 or 80 years old. Lifetime means that the policy is valid, but it does not mean that the payment will be for life. It is recommended to read the terms and conditions carefully to confirm the coverage period and evaluate whether other policies are needed to supplement the coverage, so as to truly protect the medical needs of the elderly.

There are two logics for medical insurance: one is the "return type" with higher premiums but refundable upon maturity, which is suitable for people who value the sense of return; the other is the "pure protection type" that focuses on protection and has lower premiums, which is suitable for people who want to use a small amount of money to support high protection. There is no better one, the key lies in what you need most now.

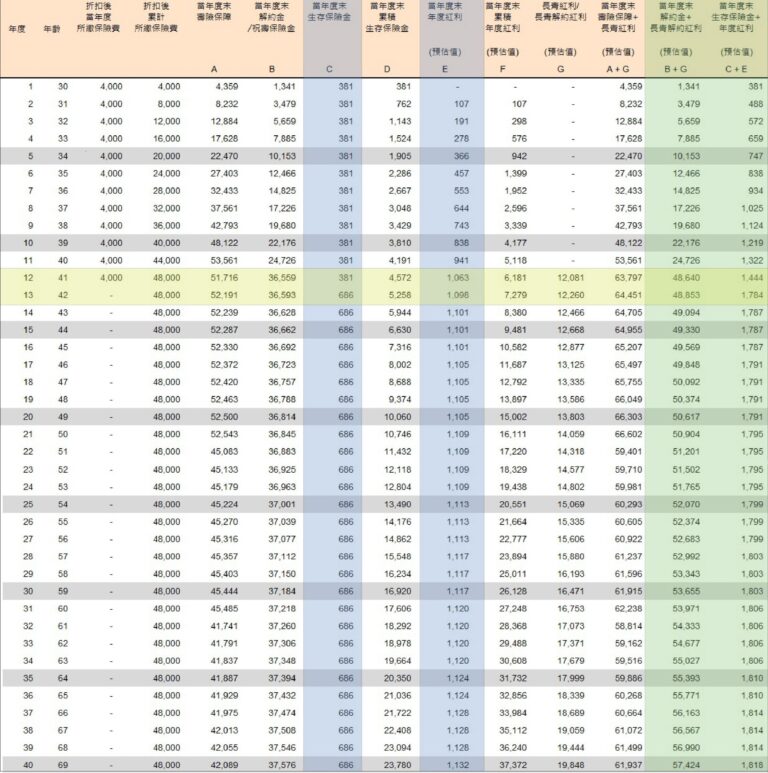

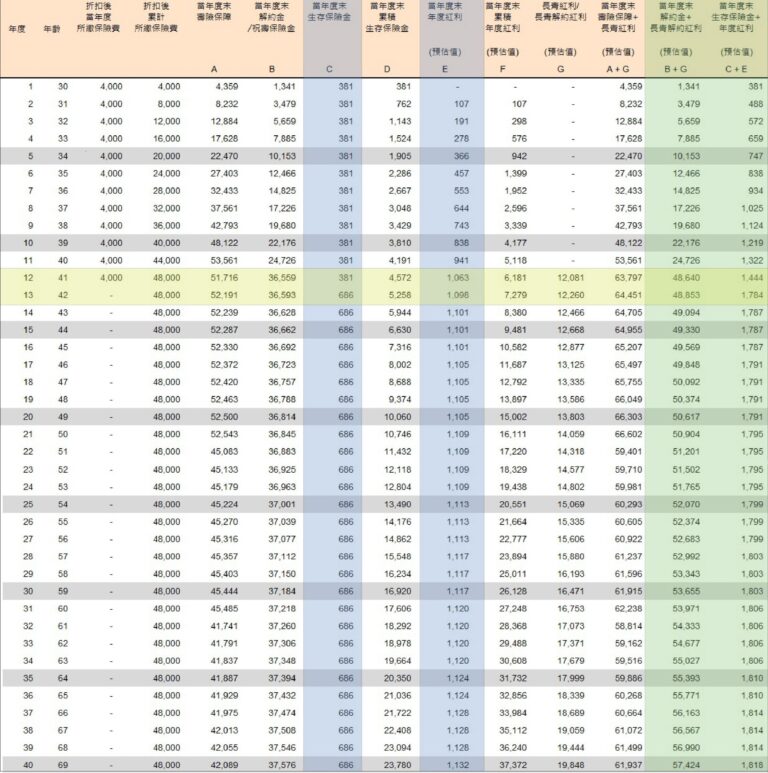

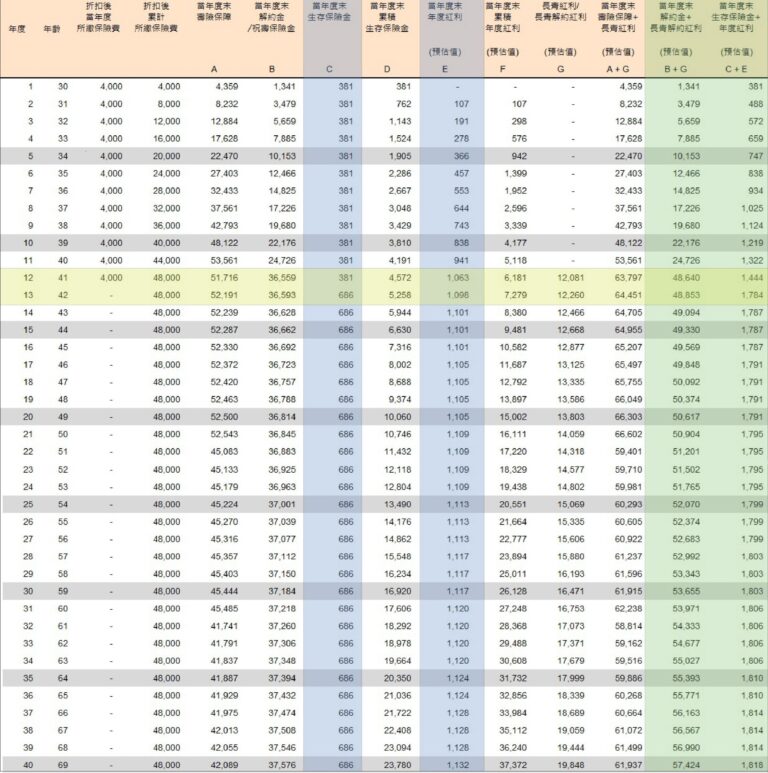

As long as you save 10,000 yuan a month for 12 consecutive years, you will have the opportunity to build an asset of 1.5 million yuan. At the same time, you will start to receive rewards from the first year, which will increase year by year, up to about 55,000 yuan per year. As long as the principal is not moved, this cash flow can even last a lifetime. In the long run, not only will the principal remain, but the total amount of rewards may far exceed the investment, becoming one of the sources of stable income after retirement. This is a stable long-term savings strategy that can be customized according to personal conditions.

After the old man who caused the Three Gorges accident passed away, if his family members gave up the inheritance, they would be exempt from paying compensation to the victims. Compulsory insurance and third-party liability insurance become the key to the victims' families' claims for compensation. If the elderly person’s insurance policy does not specify another person as the beneficiary, the compensation money will be considered as the inheritance for repayment; if someone else is specified, the insurance money will not be included in the inheritance and the family members can legally collect it. This case highlights the importance of insurance planning and third-party liability insurance.

If part of the house is used for business and the rest is for self-residence, you can still apply for self-use tax rate and tax savings. Property tax, land tax and real estate tax can all be levied separately according to the proportion of use. The key is to clearly divide the use, declare honestly and apply in time to legally achieve the best of both worlds: "self-residence, business, tax saving and tax exemption".

Property taxes have become more expensive this year, mostly because the property was not declared as a self-occupied residence, resulting in the non-owner-occupied tax rate being levied. Property Tax 2.0 has been implemented since 2015, and the tax rate for owner-occupied properties has been reduced to 1%, while the maximum tax rate for non-owner-occupied properties is 4.8%. If you miss the declaration, the Ministry of Finance has extended the deadline to June 2. Remember to transfer your household registration and apply as soon as possible to enjoy the preferential tax rate.

A certain citizen registered his house in the name of his underage son, hoping to enjoy the NT$4 million tax exemption on owner-occupied land and the 10% tax rate concession. However, his son lost his eligibility when he sold the house and was unable to enjoy the concession. It is reminded that the person who registers the property must be the individual, spouse or minor child, and must have actually lived in the property for six years in order to enjoy the tax savings benefits. It is important to avoid an increase in tax burden due to incorrect registration.

Trump proposed the "Mar-a-Lago Agreement," which aims to revitalize the U.S. manufacturing industry by devaluing the U.S. dollar and appreciating the New Taiwan dollar to 13.3 through trade and tariff measures. If this comes true, Taiwan's stock and housing markets may soar in the short term, but exports will be hit, industries will be hollowed out, and the risk of bubbles will be high, which may lead to a repeat of the tragedy of the hot money boom and financial collapse in the 1980s.