Q2:潤髮和護髮有什麼不同?

A:主要是兩種構成的分子大小有所差異性。

潤髮(Conditioner)分子較大,只做表層柔順。

護髮(Hair Mask)分子小,則能深入髮芯修護,建議一週使用 1~2 次。

若經濟條件許可的話,日常護理直接換成分子小的護髮來做,髮質會比常上髮廊護髮來得更有效果。

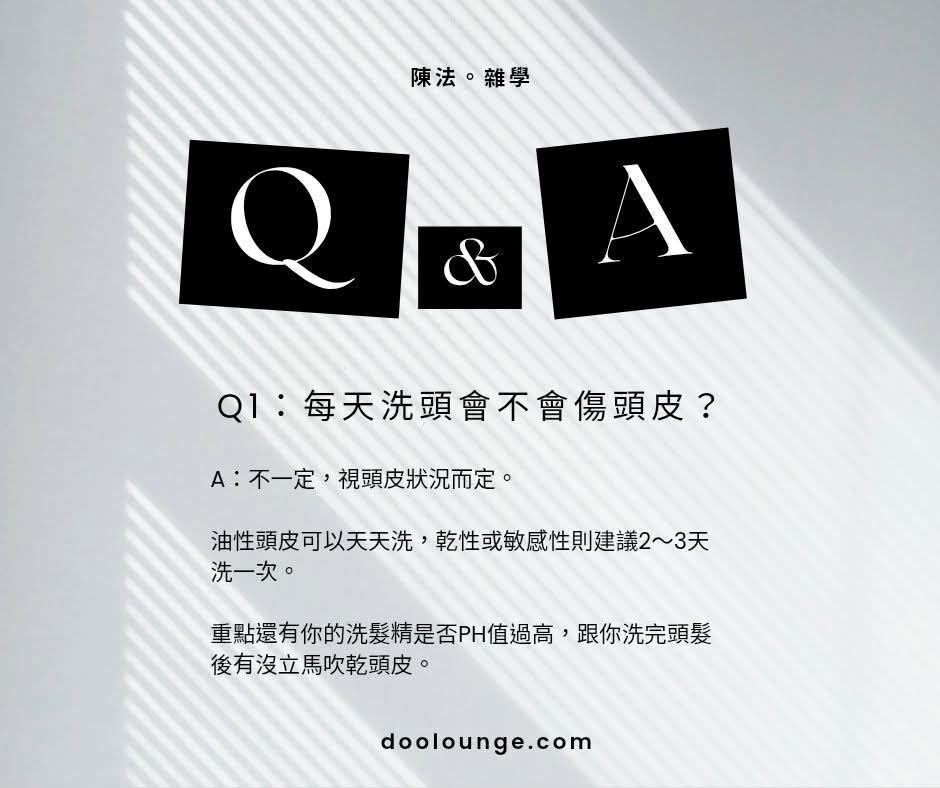

Q1: Will washing your hair every day damage your scalp? A: Not necessarily, it depends on the condition of your scalp. Oily scalps can be washed every day, while dry or sensitive scalps are recommended to be washed every 2-3 days. The key points are whether the pH value of your shampoo is too high and whether you blow dry your scalp immediately after washing your hair.

When you see that the ETF has a stable annual return of 6%, don't rush to open leverage and rush into the market! After deducting the handling fee, interest tax and inflation, the actual amount in your pocket may be less than 5%. If you still use credit investment, the interest rate spread is meager and the risk is doubled, which will make you become a leek swallowed by inflation. It is recommended for beginners to use spare money and make a long-term and stable layout.

Many people say they hate insurance, but what they hate is not insurance, but the feeling of powerlessness in the face of risk itself. Risks are everywhere, so instead of taking them on yourself, it is better to transfer them. Insurance is the most practical risk transfer tool. I don’t force anyone to buy insurance, but you should at least think seriously: when risks come, have you thought about how to deal with them?

Many people mistakenly believe that investment-type insurance policies are very risky. In fact, their risks can be freely adjusted according to personal attributes, and they also have protection functions. With a stable target and a long-term holding strategy, you can not only accumulate assets, but also withdraw them flexibly and use them flexibly. With the help of a dedicated person to adjust, you can plan your life with more peace of mind.

Most people cannot save money because of psychological barriers, including difficulty in delaying gratification, abstract goals, financial anxiety, etc., which make people feel that saving money is like continuous bleeding and despair. If you can design a system that "makes you happier the more you save money", such as giving yourself interest rewards regularly, you can make saving money easy and natural, and start the rich mode of making money from money.

The insurance industry often promotes "direct inheritance" as the best tax rate, but it may not be suitable for all situations. If there is a need for reinvestment, it is more advantageous to adopt the purchase and sale inheritance and make a high-value registration, especially for real estate in urban planning areas. The real asset allocation should consider the loan amount, tax burden and future cash flexibility. It cannot only rely on SOP, but should start from the overall situation of the customer and plan the best solution.

The biggest risk in investing is yourself! The current depreciation of the Taiwan dollar is in a "cat-shaped trend", and the US dollar is expected to rise by 9.3% when it returns to its historical average price. Entering the market at this time, combined with steady annual investment and compound interest effects, can greatly enhance asset growth. Exchange rates can only be earned once, but compound interest can be earned for a lifetime. Don't wait until you have money to save money. Now is the best time to start. Only by choosing the right products and finding the right planner can you truly move towards financial freedom.

Through insurance and land planning, tax sources can be reserved in advance, assets can be magnified, and descendants can avoid giving up inheritance because they cannot afford inheritance tax. Insurance claims enjoy tax exemptions, and real estate disposal can be selected according to the years of acquisition and appreciation potential, through direct inheritance, gift or sale inheritance, to achieve the best tax saving effect. Combined with age, existing insurance policies, and types of property, accurate arrangements can be made to make inheritance safer and the second half of life less worrying.

If the inheritance exceeds the tax-free amount, the tax must be paid before the inheritance, otherwise the property cannot be transferred. Many people are forced to abandon their inheritance or raise money because they do not have a "reserved tax source". Early planning and legally enlarging the reserved tax source can ensure that the hard-earned wealth can be smoothly passed on to future generations and avoid the family from facing the pressure of huge inheritance taxes.