If the inheritance exceeds the tax-free amount, the tax must be paid before the inheritance, otherwise the property cannot be transferred. Many people are forced to abandon their inheritance or raise money because they do not have a "reserved tax source". Early planning and legally enlarging the reserved tax source can ensure that the hard-earned wealth can be smoothly passed on to future generations and avoid the family from facing the pressure of huge inheritance taxes.

Insurance is not a tool to get rich, but a safety net to prevent risks from ruining you all at once. If you are the breadwinner of your family or cannot afford the pressure of an unexpected situation, you should configure appropriate protection. On the contrary, if your finances are sound, insurance plays a supporting role and funds can be used flexibly.

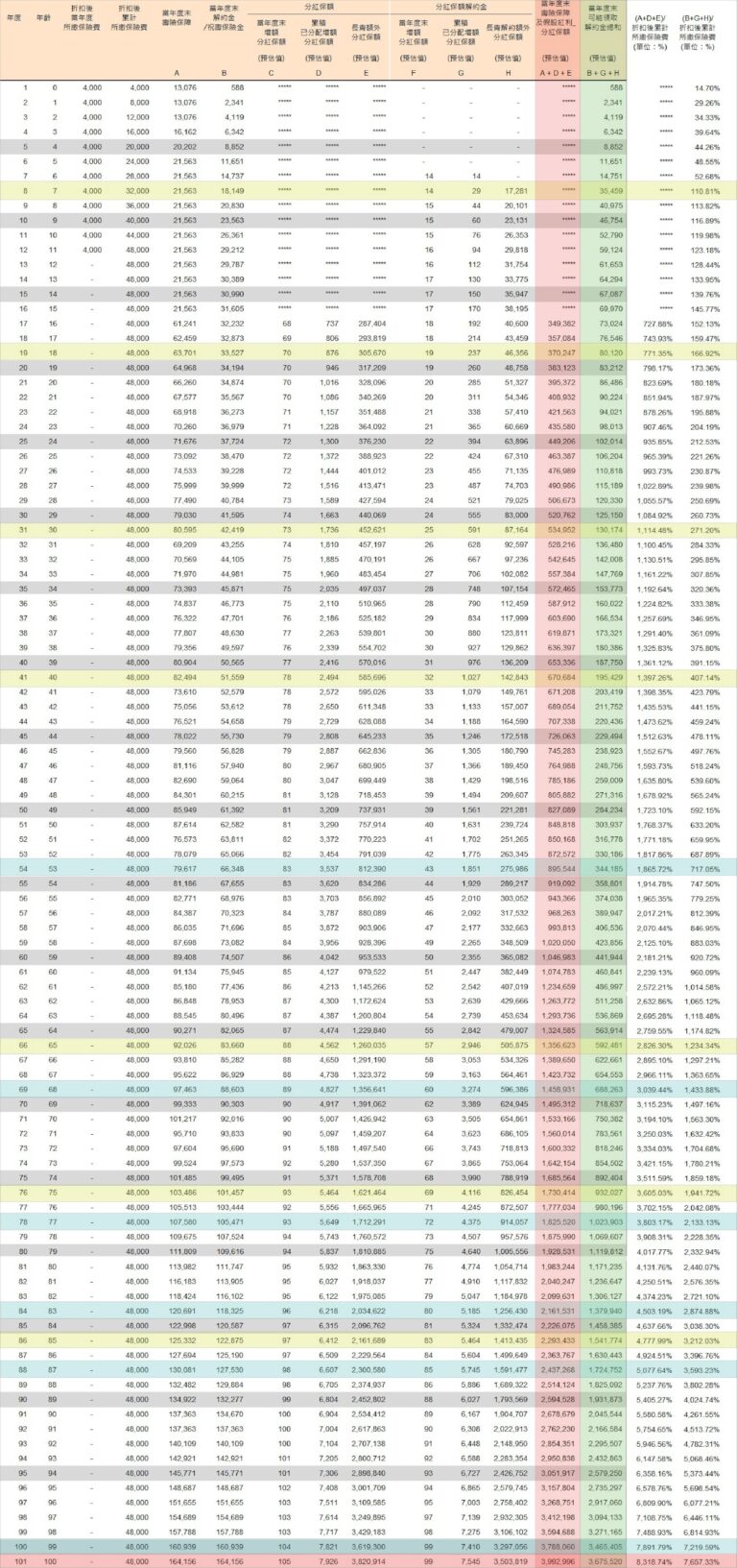

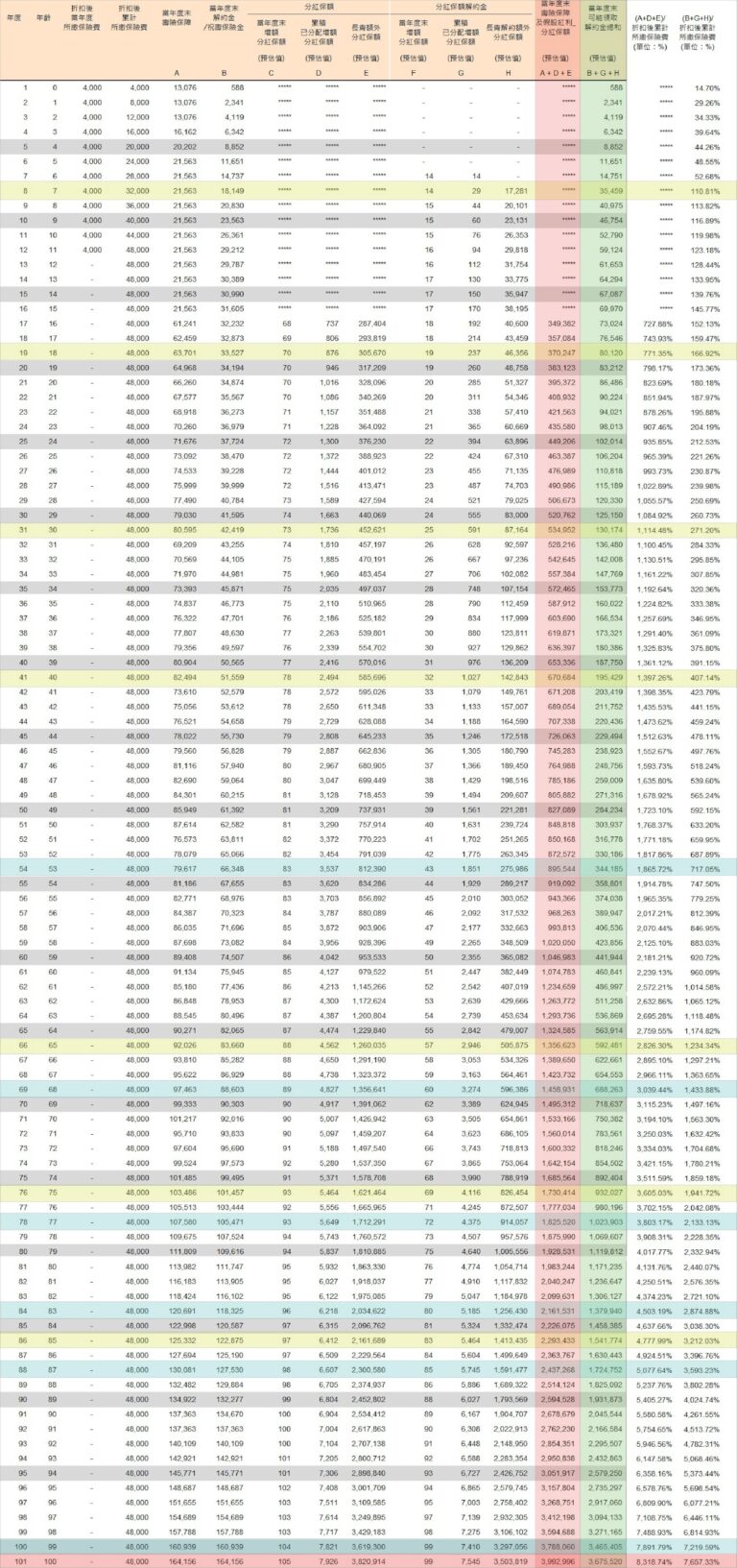

As long as you save 10,000 yuan a month for 12 consecutive years, you will have the opportunity to build an asset of 1.5 million yuan. At the same time, you will start to receive rewards from the first year, which will increase year by year, up to about 55,000 yuan per year. As long as the principal is not moved, this cash flow can even last a lifetime. In the long run, not only will the principal remain, but the total amount of rewards may far exceed the investment, becoming one of the sources of stable income after retirement. This is a stable long-term savings strategy that can be customized according to personal conditions.

A certain citizen registered his house in the name of his underage son, hoping to enjoy the NT$4 million tax exemption on owner-occupied land and the 10% tax rate concession. However, his son lost his eligibility when he sold the house and was unable to enjoy the concession. It is reminded that the person who registers the property must be the individual, spouse or minor child, and must have actually lived in the property for six years in order to enjoy the tax savings benefits. It is important to avoid an increase in tax burden due to incorrect registration.

Trump proposed the "Mar-a-Lago Agreement," which aims to revitalize the U.S. manufacturing industry by devaluing the U.S. dollar and appreciating the New Taiwan dollar to 13.3 through trade and tariff measures. If this comes true, Taiwan's stock and housing markets may soar in the short term, but exports will be hit, industries will be hollowed out, and the risk of bubbles will be high, which may lead to a repeat of the tragedy of the hot money boom and financial collapse in the 1980s.

Most people think they are investing, but in fact they are just gambling. Before investing, you should first clarify whether your purpose is to save money or to make a fortune. Short-term operations without doing your homework are just showing off. If you cannot beat the market, it is better to invest regularly and hold on for the long term. Don't waste your time pretending to do research when you can't make any money. Don’t buy if you don’t understand. Investing should be an accumulation of discipline and patience.

Stocks offer high risk and high returns; bonds offer stability but low returns. ETFs bundle multiple assets to diversify risks and are easy to operate. They are suitable for beginners and long-term regular investments. Based on age and risk tolerance, it is recommended to allocate the proportion of stocks, bonds and ETFs to achieve a stable and effective asset layout.

Stocks are like buying shares in a company, which are highly volatile but offer high returns; bonds are like lending money to the government or a company, which are stable but offer lower returns. The dual allocation of stocks and bonds is an investment strategy that diversifies risks and helps make assets more stable. Remember: Don’t invest all your money in a single tool. Rational allocation is the long-term solution.

Making money in modern times no longer depends solely on hard work, but requires improving diverse knowledge and skills to create personal irreplaceability. Create time and financial value by investing in yourself and making good use of information gaps. Before judging investment risks, you should clarify the facts and data and rationally evaluate the rate of return. Only by acting according to facts can you accumulate wealth and reverse your destiny in an M-shaped society.