Through insurance and land planning, tax sources can be reserved in advance, assets can be magnified, and descendants can avoid giving up inheritance because they cannot afford inheritance tax. Insurance claims enjoy tax exemptions, and real estate disposal can be selected according to the years of acquisition and appreciation potential, through direct inheritance, gift or sale inheritance, to achieve the best tax saving effect. Combined with age, existing insurance policies, and types of property, accurate arrangements can be made to make inheritance safer and the second half of life less worrying.

If the inheritance exceeds the tax-free amount, the tax must be paid before the inheritance, otherwise the property cannot be transferred. Many people are forced to abandon their inheritance or raise money because they do not have a "reserved tax source". Early planning and legally enlarging the reserved tax source can ensure that the hard-earned wealth can be smoothly passed on to future generations and avoid the family from facing the pressure of huge inheritance taxes.

I am not an insurance agent who only sells insurance policies, but a consultant who is committed to helping you with asset allocation and legal tax saving. From insurance license to land surveyor, I continue to study to integrate land, taxation and finance to help you find cash flow and potential assets. Do you want to talk about how to maximize the benefits of assets? You can slowly read my articles, or let's make an appointment to talk!

If part of the house is used for business and the rest is for self-residence, you can still apply for self-use tax rate and tax savings. Property tax, land tax and real estate tax can all be levied separately according to the proportion of use. The key is to clearly divide the use, declare honestly and apply in time to legally achieve the best of both worlds: "self-residence, business, tax saving and tax exemption".

Property taxes have become more expensive this year, mostly because the property was not declared as a self-occupied residence, resulting in the non-owner-occupied tax rate being levied. Property Tax 2.0 has been implemented since 2015, and the tax rate for owner-occupied properties has been reduced to 1%, while the maximum tax rate for non-owner-occupied properties is 4.8%. If you miss the declaration, the Ministry of Finance has extended the deadline to June 2. Remember to transfer your household registration and apply as soon as possible to enjoy the preferential tax rate.

Trump proposed the "Mar-a-Lago Agreement," which aims to revitalize the U.S. manufacturing industry by devaluing the U.S. dollar and appreciating the New Taiwan dollar to 13.3 through trade and tariff measures. If this comes true, Taiwan's stock and housing markets may soar in the short term, but exports will be hit, industries will be hollowed out, and the risk of bubbles will be high, which may lead to a repeat of the tragedy of the hot money boom and financial collapse in the 1980s.

After applying for a new Qing'an loan to buy a house, I regretted it due to the remote location and unstable job. I considered selling it but was worried about the real estate tax. In fact, the real estate tax is only levied on profits from price differences. If there is no profit, no tax will be levied. If the purpose is to relieve pressure, a flat transfer or a small compensation settlement is a more conservative option. It is recommended to consult the real estate agent to find a suitable exit method.

Taiwan's housing prices continue to rise. Although there has been a slight correction due to the impact of the housing crackdown policy, the overall trend is still upward due to long-term inflation and price indices. Housing prices in both north and south are high, and Chiayi City has become a potential choice. Almost the entire city is designated as an urban planning area, and housing prices are affordable. With the development of high-speed rail and the future entry of TSMC, the potential is significant. However, before investing, you need to evaluate demographic, economic and market risks and make prudent decisions.

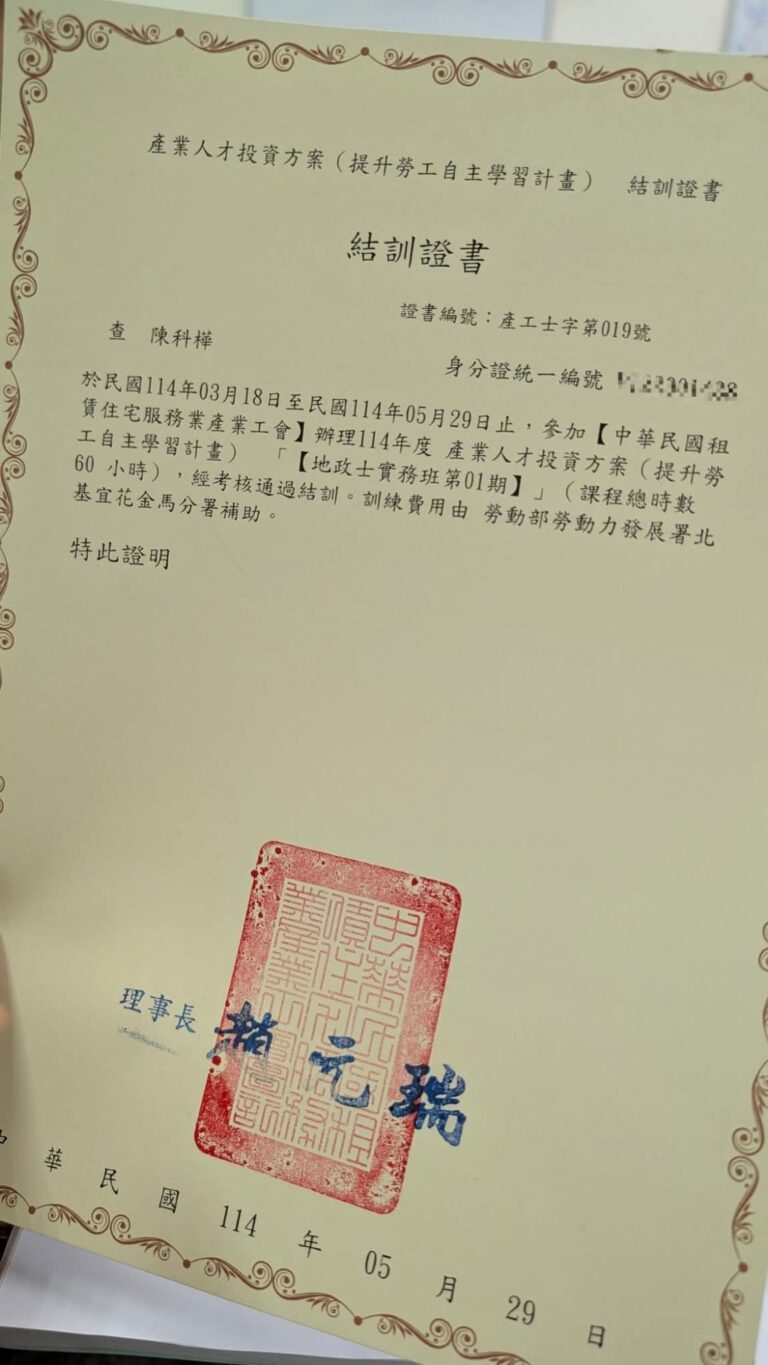

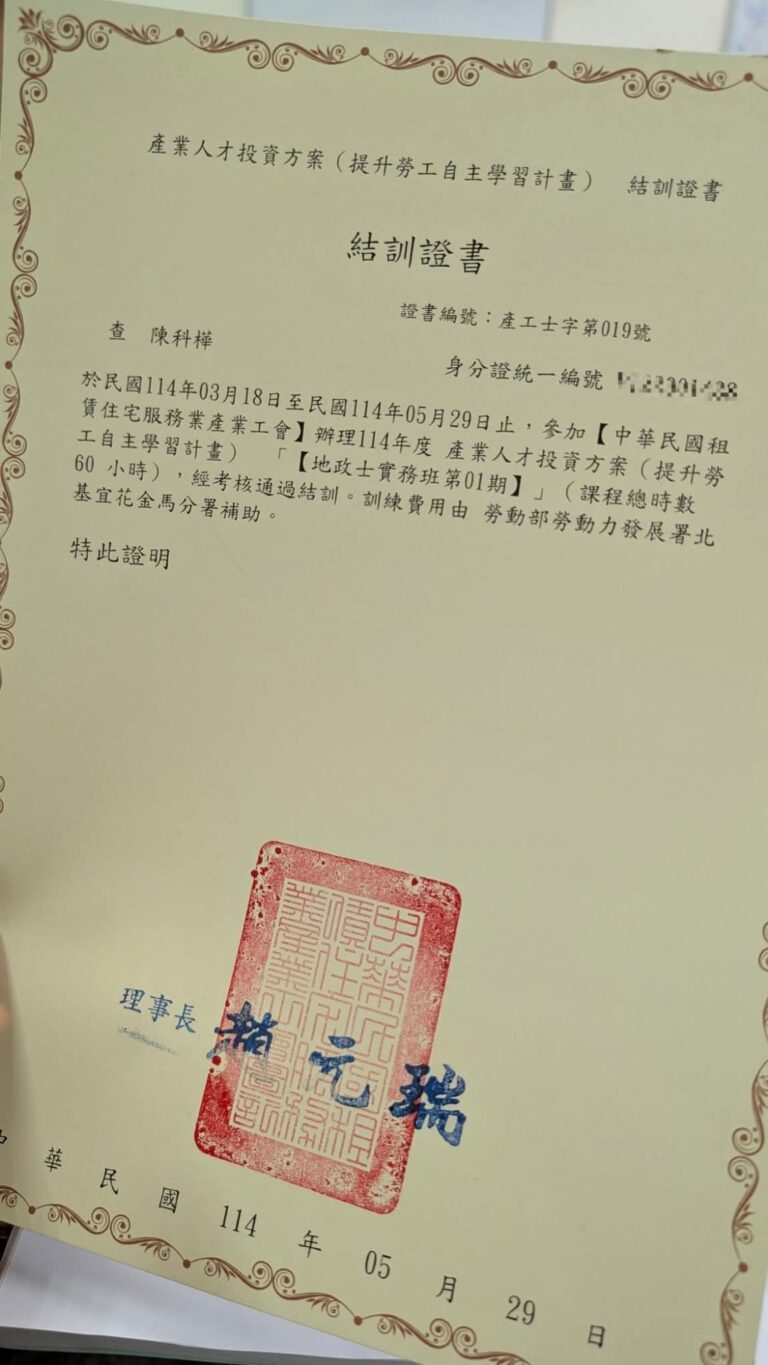

Many ups and downs occurred in 2024. In the face of bad things, I chose to devote my time and energy to learning and successfully obtained dual licenses as an insurance agent and a real estate brokerage salesperson. Although my future plans are not clear, I believe that continuous learning and exploration can make life more interesting. The parallelism and diverse perspectives brought by miscellaneous studies can often inspire unexpected possibilities. I look forward to adding highlights to my life through new skills and experiences in the future, continuing to expand my possibilities and horizons, and welcoming more exciting days.

Wealth inheritance should make good use of the annual gift tax exemption of NT$2.44 million. Cash gifts are flexible and tax-friendly, making them suitable for helping children buy a home. Real estate gifts need to consider the combined real estate tax and the risk of cost underestimation. It is recommended to increase the holding cost through buying and selling. When donating stocks, attention should be paid to valuation standards, as unlisted stocks are more risky. Policy gifting must ensure that the distribution of interests is in line with family consensus. It is recommended to consult a professional advisor to formulate a personalized plan to balance tax and family needs to ensure the smooth inheritance and appreciation of assets.