Regarding the matter of opening a store, because recently I was selling a store, and I kept encountering my first-time entrepreneurs. They came to look at the house, and then talked to me about various dreams, how to make and modify it, and I wanted a large space and cheap rent. With various dream conditions, I can only say that ideals are always full! It’s true that opening a store will make you a lot of money, but a new decoration will easily eat up your initial cost first. That is the non-recyclable item that is more exaggerated than the rent. After all, if you stop renting, you will not have to pay again. , but if you spend a lot of money on decoration, you will lose it immediately. Unless your home is really rich and you are not afraid of burning money, as long as the store is beautifully opened.

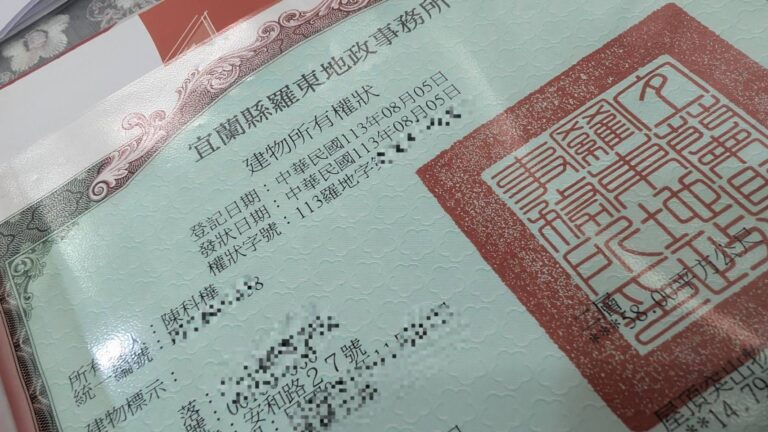

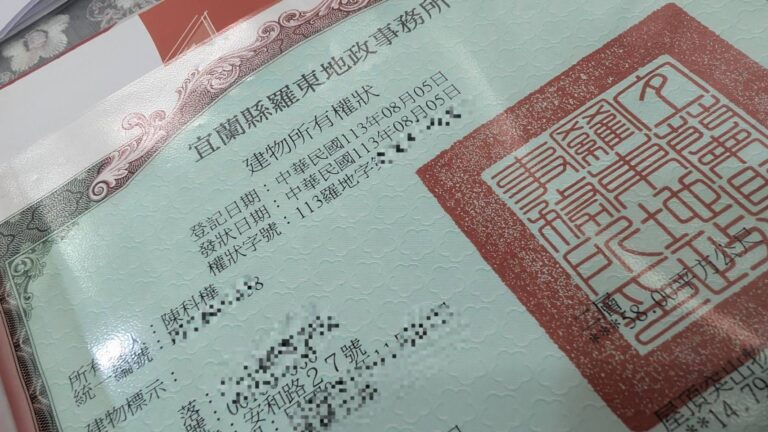

From signing the contract to getting the certificate of ownership, the process took less than a month to complete. The main reason was that I kept chasing, and I also took the initiative to interact with the bank and say hello. I was skillful in seizing the time and talking in a homely manner. It was a good person. Ways to bring each other closer. When friends see each other and they like each other, they will help you a little bit. In the future, some auction house may tell you first that there is a referral fee for referrals and transactions!

The so-called "linkage" records credit transactions between individuals and financial institutions. The total score can be up to 800 points. Regarding the retention period of various records, please refer to the regulations of the Financial Supervisory Commission for details. It is mainly compiled and collected by the Joint Financial Credit Reference Center. Through this information, a national credit database is built to ensure that people's credit transactions and the domestic financial system can be sound and stable.

The address of Love Wife on Anhe Road sounds really interesting. It’s not difficult to find there. It’s just a three-minute drive next to Luodong Sports Park!

Recently, many people have privately messaged me because 34 banks were invited to drink coffee by the government a few days ago, causing everyone to panic and ask what should I do if they are really stuck in getting a loan for buying a house? After learning about it in detail, I found out that many of them are not really unavailable, but the loans are ugly!

Policy borrowing means using the policy you purchased to borrow money from your insurance company. When the policy you purchased begins to have a "policy value reserve (referred to as premium)" as the years increase, you can apply for a policy loan from the insurance company based on your existing premium within the total policy price. Common ones include long-term life insurance, annuity insurance, etc.

As long as you buy a house for a higher price than your old house within two years after selling your house, you will be eligible for the tax refund for trading in a larger house. That overtax that sounds so scary will be written off immediately. dropped. This is the secret why rich people buy bigger and bigger houses! Because as long as I sell my original house and buy a more expensive and larger one, I can keep switching like this during the grace period. Directly, I will only pay interest forever, and I won’t be taxed heavily.

If you are not a domineering rich man who pays in full, but are a house slave who wants to apply for a mortgage, the most important thing you should pay attention to when signing the contract is that you must ask the agent to fill in this item for you. But book. If this had been filled out in the contract, it would not have caused so many people now to be anxious because the water level has exceeded the warning line, thinking that they will not be able to get the loan and will face the problem of defaulting and losing money. After all, the loan There’s nothing you can do if you don’t get it!

Taiwan's housing market is booming and banks' water levels have reached warning levels, causing many buyers to face loan difficulties and may default and lose money. Banks will not lend, waiting will not help, and the contract delivery date may come early. If you are unable to get a loan, you should consider applying for a loan from an institution that is not subject to the restrictions of Article 72-2 of the Banking Law. These institutions have preferential interest rates and are not subject to the 30% water level restrictions to meet your funding needs. If a bank loan fails, alternatives should be quickly sought to avoid the risk of default.

The real estate and land integration tax is a real estate transaction tax implemented in 2015. It is taxed on the actual income from the sale of houses and land. This tax regime applies to real estate acquired after 105 years when sold; short-term transaction tax rates are as high as 35% or 45%. The revised version 2.0 on April 28, 2010 further strengthened the regulations, including heavy taxation on short-term arbitrage, taxation on legal persons, expansion of taxation scope, prevention of tax evasion by claiming land, etc. General households are not affected by this tax at all if they do not sell or make a profit.