With the help of Xinqingan, the real estate market has soared this year and has broken through the ceiling. If you have been paying attention to real estate information recently, you will definitely have been hearing warnings that the water level is almost full, and then all kinds of messy news are flying around. tell.

Just because the new Qing'an with a five-year grace period has added fuel to the fire, newbies who are entering the real estate market for the first time may be confused as to what it means that the water level is almost full.

But looking at the people around me, it seems that the real estate brokers are very anxious. They are posting various articles everywhere, saying which bank is close to the warning line and will not lend money, and which bank has raised the interest rate to extremely high.

In fact, this can be regarded as a sales method. If you haven't entered the real estate market yet, come and buy with me as soon as possible. If you hesitate and think about it, you may not be able to buy it!

If you are buying a house for the first time, you bought a pre-sale house, and you are about to hand over the house in the near future. If you are about to start applying for a mortgage, you should be careful now. This is really a serious matter for you. .

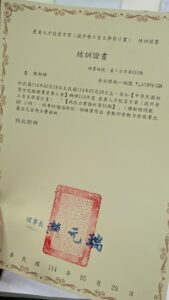

To understand what the mortgage level is, we have to talk about what is called the "Penguin's Evil". The Financial Supervisory Commission issued "Article 72-2 of the Banking Law" and the limit regulations on "residential construction and corporate construction lending".

In order to avoid excessive concentration of bank funds in construction lending, which will cause a crowding-out effect of funds, it is necessary to adapt to the needs of industrial development, and also to prevent banks from affecting the stability of their operations due to fluctuations in real estate market prices.

The total amount of residential construction and corporate construction loans provided by a commercial bank shall not exceed 30% of the total balance of deposits received at the time of lending and the amount of financial bonds sold.

Just because this clause of the Banking Law is afraid of a single financial operation, if the market crashes accidentally and a run occurs in the future, the seriousness is likely to lead to bank failure, and it limits the basis for banks to lend unilaterally. That 30% is the water level that everyone has been spreading.

To give a brief explanation, if the total amount of revenue and expenditure that the bank can earn this month is 10 billion, it can only lend 3 billion for single-oriented lending. That 3 billion loan is commonly known as the "30% water level." Is there any explanation for this? Simpler and clearer.

The housing market is so hot this year, and it has only just passed half a year. At present, many banks have reported that it has reached the 28% water level warning line, which means that they will soon be unable to lend.

For banks, the purpose of lending is to collect interest and make money, but it is almost full. Of course, it can no longer be approved without thinking. Anyone can simply get by.

Of course, some phenomena will occur at this time. Banks will start to screen so-called high-quality customers before lending. The conditions for those high-quality customers are to see whether you have any collateral, or it seems that you can repay the loan well and will not default on the loan. employees of the enterprise.

For the novices in the real estate market who are poor and have nothing, they cannot be completely shut out of the market, so there is a so-called increase in interest rates, which is proportional to the decrease in loans! After all, banks can also earn more money in this way.

In other words, when you bought a house at the beginning of the year, you may have seen those excellent 80% loans and low interest rates. In this period of rising water levels, such benefits are no longer available! It is very likely that you will have to prepare more on hand and pay more than 10% of the down payment, or you may be asked to pay more, forcing you to accept loan terms with higher interest rates.

Especially in the second half of the year, pre-sale homeowners who have completed construction and are ready to hand over their houses are starting to apply for mortgages! I'm really going to have a headache!

The solution is to quickly ask your builder if you can defer payment until the bank water level drops.

If it really doesn't work, just ask them which bank they are working with, and then ask the bank staff what the current water level is. If it has exceeded the warning line and the conditions have become extremely poor, they will try to see if they can let you apply to another bank.

Everything I mentioned is really important. Otherwise, if you wait until you are due to pay, you will slowly inquire about applying for a mortgage loan, and then you will find that the bank is full and you will not be able to apply for a loan at all, which will make you unable to pay. If you pay a huge amount of money to buy a house, you will be beheaded!

Not only will the house disappear directly, but you will also have to pay a large amount of liquidated damages. That would really make you cry!

In this situation where water levels are rising and everyone is in danger, when applying for a home loan, you do not want low percentages and high interest rates. The only solution is to quickly find those lending institutions that are not subject to the "Penguin Evil" restrictions. These institutions As follows: Land Bank, Life Insurance Company, Farmers and Fisheries Association (Credit Department), Credit Cooperative, Post Office, Financing Company.

I wish all the novices who have just entered the real estate market recently, that everyone can buy the good house they want with the highest percentage and the lowest interest rate!

# Xinqing'an # Home loan # Eighty percent # Interest rate # Water level # Warning line # Full water level # Thirty percent # Bank # Ceiling # Penguin's evil # Banking law # Financial Supervisory Commission #722 terms # Screening # High quality # Top 100 companies # Poor and white # Housing market # Liquidated damages # Land Bank # Life insurance company # Farmers Association # Fisheries Association # Post office # Credit union # Financing # Ratio # Interest rate # Builder

This website does not have those annoying ads that block the webpage and hinder reading!

If you think the article I wrote is helpful to you, could you please fill in a Questionnaire, allowing me to better understand everyone’s needs and write more high-quality content.