I originally thought about whether I really need to write a hand-opened two-part invoice and the difference between a three-part invoice, but I always feel that I am mentally retarded. Do I need to write something special?

But I'm afraid that the young people in the thatched cottage are ignorant, so I'd better explain it briefly to everyone.

Basically, manual invoicing is mostly done because the transaction volume is small and it is convenient for various things. There is no need to buy a separate machine just to issue invoices.

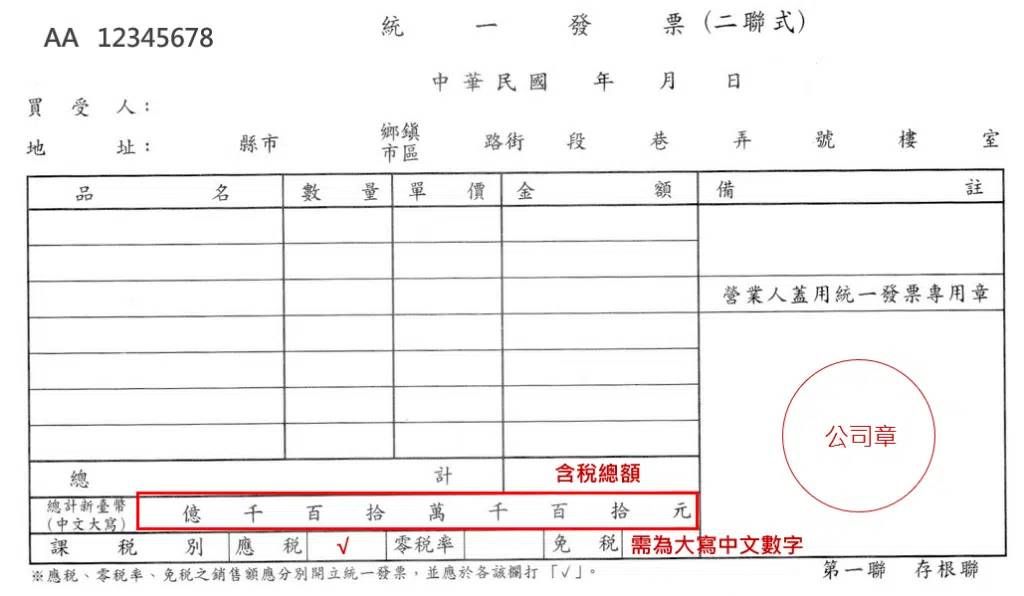

Two-part unified invoice:

It is specially used by business people who sell to general individual consumers, "B2C" Business (business) to Customer (individual). This type of invoice is mostly issued to general individual consumers or foreign companies. The buyer can request to publish the buyer's name. As a reward.

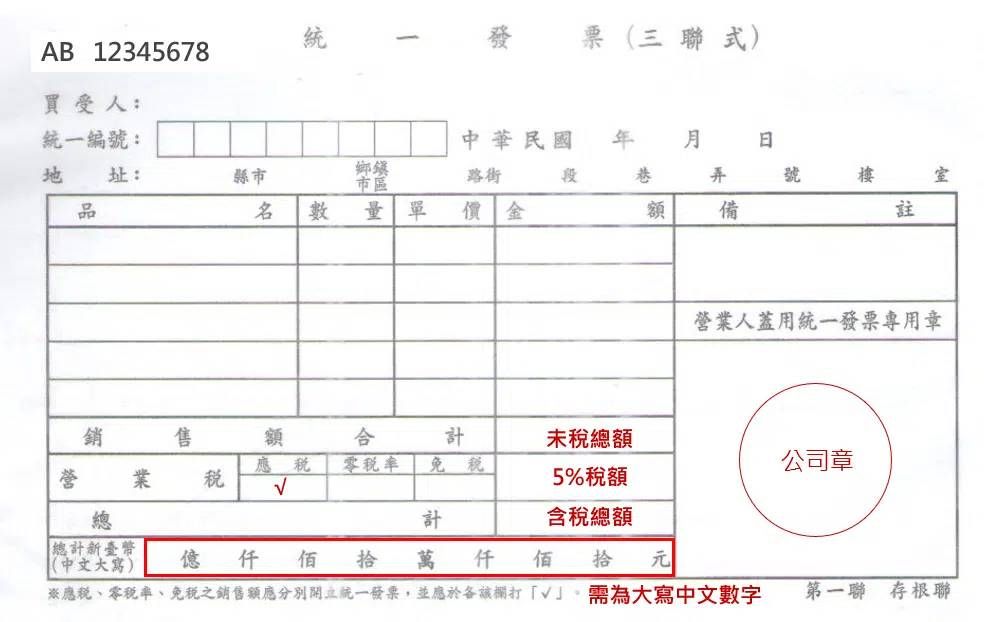

Triple unified invoice:

It is exclusively for use by "B2B" Business to Business traders who do business with company accounts. The buyer's unified number must be printed on all invoices.

The difference between the triple-part unified invoice and the two-part unified invoice is mainly that the triple-part invoice has an additional stub copy compared to the receipt copy and deduction copy of the two-part invoice, so that the buyer with the same company bank number can use it as a stub. Use.

In this way, it is easier to know in detail what the difference between the two types is. The simplest difference is that one can be unified and the other cannot be unified. This is because only triple-type invoices have an extra line. , the unified invoice format allows you to fill in.

You need to take it to an accountant to offset business tax. If it is an invoice without your company's unified number, do you think it will be returned?

Moreover, invoices are usually issued by hand. For small amounts, items can be abbreviated, such as a batch of stationery. After all, small amounts and small amounts are difficult to check and picky.

But if it is a large-amount hand-issued invoice, the items will definitely be written in detail. After all, it is used to write off the accounts, and it is easy to be audited. If you are not really blind and think that the accounting is very simple, you are not afraid of being audited. That would be super abbreviated.

This is basically super basic common sense for starting a company. I wanted to write it down briefly, but the result was that I typed out a lot of it inexplicably.

I am afraid that young people are ignorant and want to take the teaching manual issued by the thatched cottage and help Master everywhere, so I wrote it to let everyone know more about it. After all, everyone will have the opportunity to be a boss in the future!

# Kuomintang # Xiaocao # Ke Wenzhe # Muke # Neo # Shile # Company # Invoice # two-part # three-part # unified invoice # unified number # accounting # business tax # discount # income tax # accountant # Duanmu Zheng # Court # Office # Complaint # Huang Guocong # Huang Shanshan # Chen Zhihan # Political Donation # Beijing Inspection # False Accounts # Politics # Black Gold # Corruption

By the way, I would like to teach you that on the websites of the Finance and Taxation Bureau, the Ministry of Finance and other websites, the word "Taiwan Uniform Invoice" is used for unified invoices.

This should also be easy to distinguish between two-part and three-part invoices, which have different English usages!

As for the unified invoice draw every two months, you can use the "Taiwan Invoice lottery", which means an invoice that has the same chance of winning the lottery.

This website does not have those annoying ads that block the webpage and hinder reading!

If you think the article I wrote is helpful to you, could you please fill in a Questionnaire, allowing me to better understand everyone’s needs and write more high-quality content.